Peer-to-peer lending is gaining more attention, especially in developing countries, such as Indonesia, Malaysia, and Vietnam. Peer-to-peer lending, also known as P2P lending, is a money lending activity to businesses or individuals throughout online websites/apps. The lender, called a P2P company, offers lending services with an easier process than traditional lending practices. This new rise within the fintech industry in Vietnam is getting hot and is ripe for investment.

Interested in Investing in Vietnam’s Fintech Industry?

Check out Cekindo’s Company Incorporation Services

Borrowers, both individuals or businesses, that borrow money from the lender can get the loan at lower rates. Because of that, many new borrowers are constantly attracted to take part in the practice, including in Vietnam. Peer-to-peer lending companies in Vietnam are commonly found targeting particular people, even when the regulations are still not fixed yet.

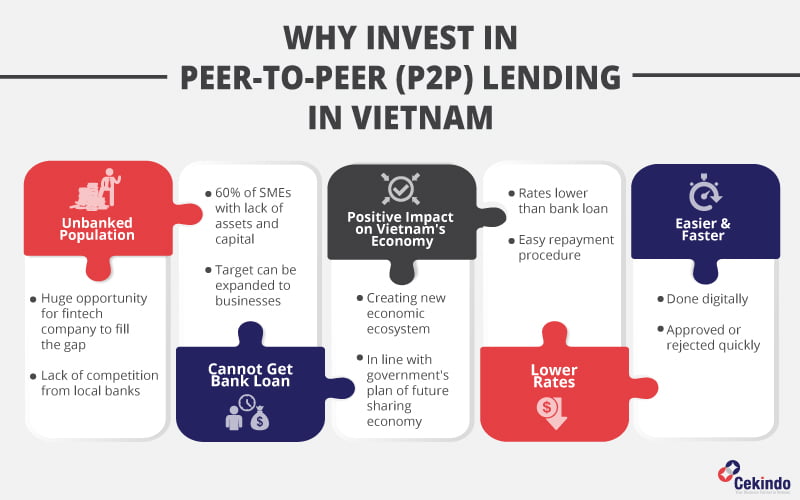

5 reasons peer-to-peer lending is really hot in Vietnam

1. There are So Many Unbanked Individuals

Many Vietnamese are still unbanked. It means that there is a big market for a fintech company. Vietnam is one of the developing countries that has a large number of productive citizens, and even those are not all using banks. Over 60% of Vietnamese are in the ages of between 15 and 55. This group is more likely tend to take out loans to buy their needs, such as home, car, and investment.

However, since there are so many Vietnamese people who are still unbanked, the opportunity is very huge for a fintech company to fill the gap. The P2P lending market is really hot due to the vast market and lack of competition from local banks.

RELATED: Important Regulations About Fintech in Vietnam

2. Many Companies are Unable to Get Bank Loan

As mentioned above, P2P lending is not only targeting individuals, but also businesses. One reason P2P lending is gaining much attention is because there are so many companies unable to get a bank loan. Talking about numbers, there are 60% of companies that cannot get a bank loan. Most of them are small and medium enterprises with a lack of assets and capital.

3. Bring Positive Impact to Country’s Economic Development

Deputy Prime Minister of Vietnam Vuong Dinh Hue explains that P2P lending creates a new economic ecosystem by involving citizens to interact with financial institutions. The existence of a P2P lending company reflects the government’s plan to create a sharing economy for the future. The loan will help individuals or companies that are not reached by traditional banks.

4. Lower Rates

Borrowing money from P2P lending companies has become a trend among millennials. Most fintech companies offer a lower rate than a bank loan and easy repayment procedure. However, the rates may gradually increase depending on the loan period. The borrower must pay off the loan before the due date to avoid any higher rates. In some cases, borrowers have to pay a fine due to late repayment.

5. Easier and Faster

Since P2P lending operates an online system, the whole lending process is easier than the traditional ones. All procedures can be done digitally, without any face-to-face meeting. It takes less time to complete the procedures. After completing all the steps, the loan will be approved or rejected quicker.

Most of the P2P lending companies require you to input customer’s data for the verification. For example, an ID card that had been published by authority, salary slips, and other personal documents. Since the personal information must be shared with P2P lending company, customers are supposed to pay more attention to the company’s legal standing, to avoid any risks in the future.

Ready to Open Your Own P2P Lending Business?

Since P2P lending is popular across millennials, you need to take part in it and expand your business in Vietnam.Registering your company is the first step to start your promising business. Cekindo can assist you with company registration and business licenses in Vietnam, among others.

Contact us through the form below and we will guide you every step of the way, from informing you about the requirements and procedures to assisting you in assisting your P2P lending company in Vietnam.