Starting a business in Vietnam as a foreigner often involves navigating regulatory restrictions. A nominee shareholder arrangement offers a practical solution, enabling a local nominee (registered owner) to hold company assets and manage operations on behalf of the foreign investor (beneficial owner) while ensuring compliance with local laws.

This arrangement allows foreign investors to access restricted sectors, maintain anonymity, or operate in industries requiring special permits. With the nominee handling administrative tasks, the foreign investor retains full control over resources and strategic decisions.

This article explores the benefits and processes of nominee shareholder arrangements, highlighting their value for foreign investors in Vietnam.

Setting up a business in Vietnam? Check out InCorp Vietnam’s Incorporation Services in Vietnam

What is the Definition of a Nominee Shareholder in Vietnam?

A nominee shareholder is a local Vietnamese individual/organization (usually individual) that is the one registered as an owner/shareholder on a company license to meet the requirement of the Vietnam law for the benefit of the foreign investor.

Under Vietnam’s WTO commitments and applicable laws, certain business sectors are classified as restricted or conditional for foreign investment, limiting or prohibiting foreign ownership in company capital. To overcome these limitations, foreign investors can leverage nominee shareholders, a practical solution that enables compliance with local regulations while facilitating access to restricted sectors.

A nominee shareholder is a local Vietnamese individual or organization registered as an owner or shareholder on the company license. This arrangement fulfills legal requirements and shields the actual owner’s identity, allowing foreign investors to participate in sectors that would otherwise be inaccessible. In this setup, the nominee holds the business license in their name, but the capital and operational control remain with the foreign investor, who is referred to as the beneficial owner.

Many foreign investors favor nominee structures because they resolve challenges associated with Vietnam’s business environment. A nominee shareholder, often called the registered owner, can also act on behalf of the foreign investor to handle administrative tasks, legal matters, resource procurement, and financial arrangements. Despite these responsibilities, the nominee plays a non-executive role with minimal decision-making power, ensuring that the beneficial owner retains full control of the company. This approach not only ensures compliance but also provides an efficient pathway for foreign participation in restricted business lines.

Is It Safe to Use Nominee Arrangement for Business in Vietnam?

Nominee arrangements in Vietnam can be a safe and effective solution for foreign investors, provided they conduct thorough due diligence and engage reputable consultants.

Given the prevalence of unqualified agents in the market, it is essential to invest time in identifying a reliable and trustworthy service provider. Working with a credible consultant ensures that the nominee arrangement process is handled efficiently and securely, minimizing potential risks.

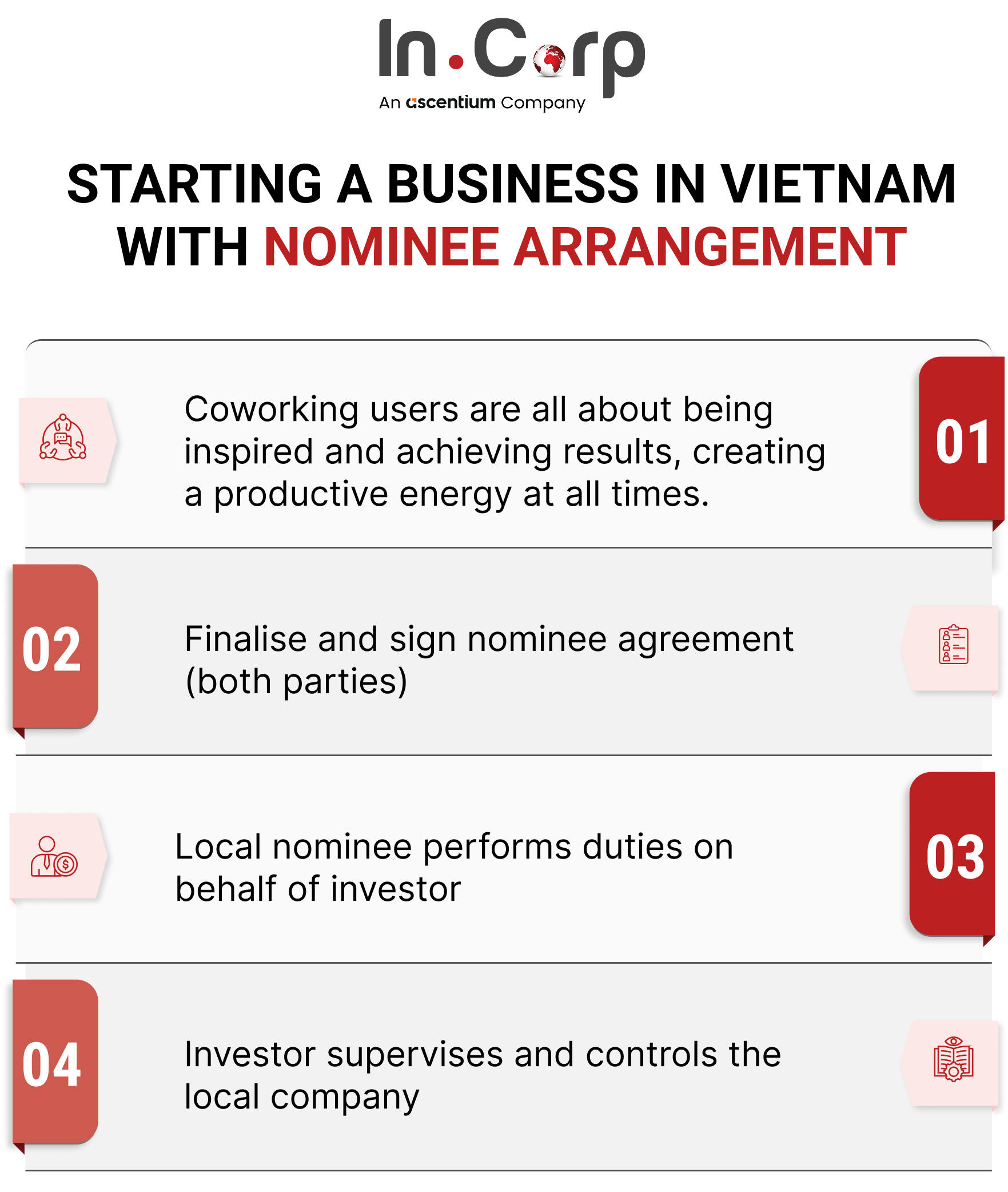

Nominee Arrangement Process in Vietnam

A nominee arrangement is among the simplest methods for establishing a company in Vietnam. Below is a concise overview of the requirements and steps involved:

- Capital Contribution: The foreign investor, referred to as the beneficial owner, must provide capital contributions to set up a local company under the name of the local nominee (the registered owner). The nominee can be either a Vietnamese individual or entity.

- Finalizing the Agreement: Both parties should formalize the nominee agreement through a professional consultant to ensure legal compliance and clarity in roles.

- Nominee Responsibilities: The registered owner assumes responsibility for tasks such as daily operations, administration, procurement, legal issues, communications, and financial arrangements. These tasks are carried out under the strict instruction, direction, and supervision of the beneficial owner.

- Beneficial Owner Control: Despite the nominee’s operational role, the beneficial owner retains full control of the company, including strategic decision-making.

For conditional business lines, specific foreign capital ownership limits apply, such as 51%-49% or 99%-1%. In such cases, the investor and nominee shareholder collaborate to form a joint venture company in compliance with Vietnamese regulations.

Benefits of Using a Nominee Shareholder in Vietnam

A registered owner in a nominee company acts as the nominee shareholder. While officially listed as a shareholder under the company, the nominee shareholder is an unrelated third party who does not own the shares or exercise real control over the company. This role is distinct from the nominee director, or beneficial owner, who retains full control and ownership of the company’s assets.

Nominee structures offer numerous benefits for foreign investors navigating Vietnam’s business environment. These structures simplify the process of establishing a business, particularly in sectors restricted for foreign investment. They shield the beneficial owner’s identity, providing anonymity and diverting competitors’ attention. This privacy helps protect foreign investors’ rights while ensuring their control over the company.

Additionally, nominee arrangements streamline registration and compliance tasks, such as opening bank accounts and handling legal obligations, reducing technical and legal complexities. They also allow foreign investors to access Vietnam’s tax benefits, as nominee companies qualify as local entities under Vietnamese law. By simplifying investments and securing legal and financial advantages, nominee structures have become a globally adopted strategy, widely applied in Vietnam to facilitate foreign participation in restricted or conditional business sectors.

Advice for Using a Local Nominee in Vietnam

While many agencies in Vietnam offer nominee arrangement services, not all deliver reliable or effective outcomes. Unfortunately, some are untrustworthy, disappearing after collecting fees or providing agreements that are invalid or legally unsound. Common issues with such agencies include inadequate protection for foreign investors, prolonged processing times, and potential legal complications.

To avoid these pitfalls, thorough research and consultation with reputable experts are crucial. Choosing a credible agency ensures a secure and compliant nominee arrangement, safeguarding your investment and facilitating smooth business operations.

Take a proactive approach to protect your interests. Contact us for fast, hassle-free business registration and receive a free quotation on our reliable local nominee agreement services.

clients worldwide

professional staff

incorporated entities in 10 years

compliance transactions yearly